From a business owner’s point of view, asking for upfront payment makes a lot of sense. Nonetheless, this doesn’t make the situation any more pleasant. While it can be challenging to strike the right balance between protecting your business interests and maintaining a positive relationship with clients, addressing this issue with care and professionalism is key.

Whether you’re a yoga instructor, personal trainer, or a small business owner, understanding how to approach this topic can make a significant difference in your financial stability and client interactions.

Many business owners struggle to navigate this request without coming across as demanding or untrustworthy. So, in this blog post, we’ll explore effective strategies on how to ask for upfront payment in a way that feels considerate. However, we’ll first dive into the basics of upfront payments and why they are so important.

What are Upfront Payments and Why You Should Implement Them?

Upfront payments refer to the practice of requesting clients to pay a portion of the total fee before you even start working with them. This arrangement is often implemented to ensure commitment and cover initial costs associated with the service.

Asking for payment in advance can help business better manage their appointments or have something to recoup their losses if the client doesn’t show up. The practice reduces financial risks, improves cash flow management, and optimizes resource utilization.

For customers, using this strategy means they will have a guaranteed time slot and a service provider ready to assist them. Despite all the anxiety of implementing this approach, it will help you better manage client relationships in the long run. Partnering with an open banking payments provider can streamline these transaction processes and enhance customer payment experiences.

Image by vectorjuice on Freepik

Different Types of Upfront Payments

While various terms describe the practice of asking for an upfront payment, there are essentially four key types that businesses use:

- Partial Upfront Payment: The customer pays a part or a percentage of the total fee before the appointment. They then pay the remaining balance at a later stage or upon completing the project. Many businesses use this type to cover initial costs and demonstrate commitment.

- Full Upfront Payment: In this model, the customer pays the entire amount before the appointment takes place or the product is delivered. Businesses use this arrangement for customers who are prone to no-shows or late appointment cancellations.

- Deposit: A smaller amount paid in advance to secure a service or product. The deposit is usually a fraction of the total cost and is often non-refundable if the client cancels.

- Retainer: A regular, often monthly, upfront payment made to retain a service provider’s availability. This is common in consulting or legal services industries, where ongoing access is needed.

Depending on the industry you are in, one or the other method can give better results. Either way, selecting the appropriate type of upfront payment is crucial for balancing financial stability with client satisfaction.

Pros and Cons of Asking for Upfront Payment

Before you make any radical changes and implement upfront payments as a new strategy in your business practices, take a look at some of the advantages and disadvantages this approach offers.

Pros of upfront payments

- Better Cash Flow – Upfront transactions of this kind help businesses better manage cash flow. You can use the capital to cover initial expenses or to invest in needed resources.

- Reduced Risk – Settling the amount partially or in full in advance provides a financial safeguard against potential defaults or late payments.

- Commitment – Upfront payments will help you filter out customers who may not intend to show up. This way, you are left with the customers who want to commit to the service or a purchase.

- Resource Allocation – With upfront funds, businesses can allocate resources more efficiently, plan better, and avoid any potential disruptions.

- Reduced No-shows and Last-Minute Cancellations – Generally, when a customer pays in advance, whether in full or only a percentage of the service, they are more likely to attend the appointment, which will help you reduce last-minute cancellations.

Cons of upfront payments

- Client Reluctance – Some clients may be hesitant or unwilling to make an upfront payment. This can lead to lost opportunities or difficult conversations.

- Risk Factor – Clients might interpret the request for upfront payment as mistrust, potentially impacting the business relationship.

- Administrative Burden – Managing and tracking upfront payments can add administrative burden, particularly for businesses with numerous transactions or clients.

By weighing these pros and cons, businesses can make informed decisions about whether to implement upfront payments and how to effectively communicate this practice to their clients.

When we look at the lists, we see that the benefits of these payments always outweigh the cons, which is why so many people already use them in their business operations. However, you may find the strategy hard to implement or drawbacks more pronounced in certain situations. Either way, be sure to carefully consider all the factors before making any final decisions.

How to Ask for Upfront Payment: Step-by-Step Guide

If you’ve decided to give this approach a go, you may find it overwhelming and unsure where to start. To help you navigate how to ask for payment in advance, we’ve created a step-by-step guide. Thus, here is how to make this process smooth and straightforward for both you and your clients.

1. Define the terms

Before approaching the client, define your payment terms clearly. Outline them in a document and specify the amount required upfront, total costs, and cancellation policy. This way, you can avoid any confusion on the client’s side down the line.

2. Communicate it with the client

Explain to your clientele why you need upfront payments. Emphasize the benefits clients have from this policy, such as securing their spot or covering initial costs. Approaching it this way makes them far more likely to accept the terms.

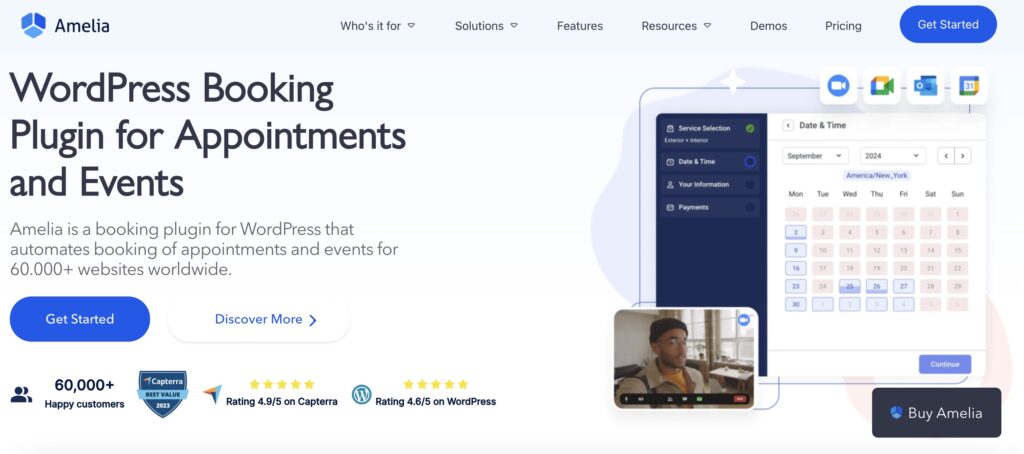

Simplify Upfront Payment Handling with Amelia

Amelia is an all-in-one booking plugin designed to help you easily navigate the world of upfront payments.

This powerful booking tool offers a comprehensive solution for appointment scheduling, upfront payments, cancellations, and many other booking needs. Looking for a way to make your life as a service business owner easier? Look no further than Amelia!

How can Amelia help you?

- Payment integrations with PayPal, Mollie, WooCommerce, Stripe, and RazorPay will help you gather upfront payments securely and reliably. These trusted platforms provide robust safeguards against fraud, offering you and your clients peace of mind.

- With Amelia’s deposit payment feature, you can easily enable this option and set either a fixed amount or a percentage of the cost for the client to pay before the appointment.

- Want to simplify payments even further? Allow your customers to pay via a link. This option lets them complete transactions quickly from any device by following the link you provided.

- Amelia also offers hassle-free refunds directly through the platform. Simply choose which payment to send back, and the system will take care of the rest, leaving you at ease and your clients satisfied.

With these features and many more, the Amelia booking plugin will help you streamline your scheduling process and manage upfront payments efficiently.

What are you waiting for? Experience Amelia firsthand and discover how it can revolutionize your business!

3. Provide a detailed proposal

Your proposal and invoice should have a detailed scope of work, deliverables, and the amount you require upfront. For an organized approach, you could consider using a Contractor Invoices Receipt Template.

It’s also advisable to include the timeline for lengthy projects. Include the expected start date if the proposal is accepted, and send the whole document via email. When sending to multiple clients or stakeholders, consider using bulk email services to ensure timely and efficient delivery of your proposals and invoices.

4. Address any client concerns

Be prepared to address any concerns or objections the client might have regarding the upfront payment. Offer solutions or compromises if necessary while ensuring that your business needs are still met.

Image by pch.vector on Freepik

5. Provide payment instructions

As you are looking at how to get paid upfront, don’t forget to include clear instructions for the client. Specify the accepted payment methods, such as bank transfer, credit card, or online payment platforms. Make sure the process is straightforward and secure to prevent any potential issues.

Asking for Upfront Payment: Email Template

Dear [Client’s Name],

I hope this message finds you well.

As we prepare to embark on the [project/service] together, I wanted to touch base regarding our payment arrangements. I’m excited about the opportunity to work with you and am confident that we will achieve excellent results.

To ensure we can commence the [project/service] seamlessly, I kindly request an upfront payment. This advance will enable us to secure the necessary resources and allocate dedicated time, allowing us to deliver exceptional results efficiently.

Attached, you will find a detailed [proposal/invoice] outlining the project scope, deliverables, and the total upfront payment required, which amounts to [amount].

We understand that upfront payments can prompt questions or concerns. If you have any further questions, please do not hesitate to reach out.

Please follow the instructions in the attached [proposal/invoice] to complete your payment. Upon receipt, we will confirm and promptly start on your [project/service].

Thank you for your cooperation and trust. We are eager to begin this project and deliver results that exceed your expectations.

Best regards,

[Your Name]

[Your Position/Title]

[Company Name]

[Contact Information]

Conclusion

Asking for an upfront payment might initially feel daunting, but it’s a strategic move that can significantly benefit your business. By clearly defining payment terms, communicating effectively with your clients, and leveraging tools like Amelia, you can manage this process smoothly and professionally.

While you should weigh the pros and cons, keep in mind that the right approach can help secure your financial stability and foster a more committed client base. Remember, the goal is to find a balance that supports your business needs while maintaining positive client relationships.

Ready to take the next step? Explore how Amelia can transform your booking and payment processes today!