Every no-show means lost revenue, idle staff, and extra admin chasing payments. But what if you turn bookings into firm commitment?

Amelia does just that by letting you require deposits or full prepayment at checkout – clients secure their slot, you secure your cash flow.

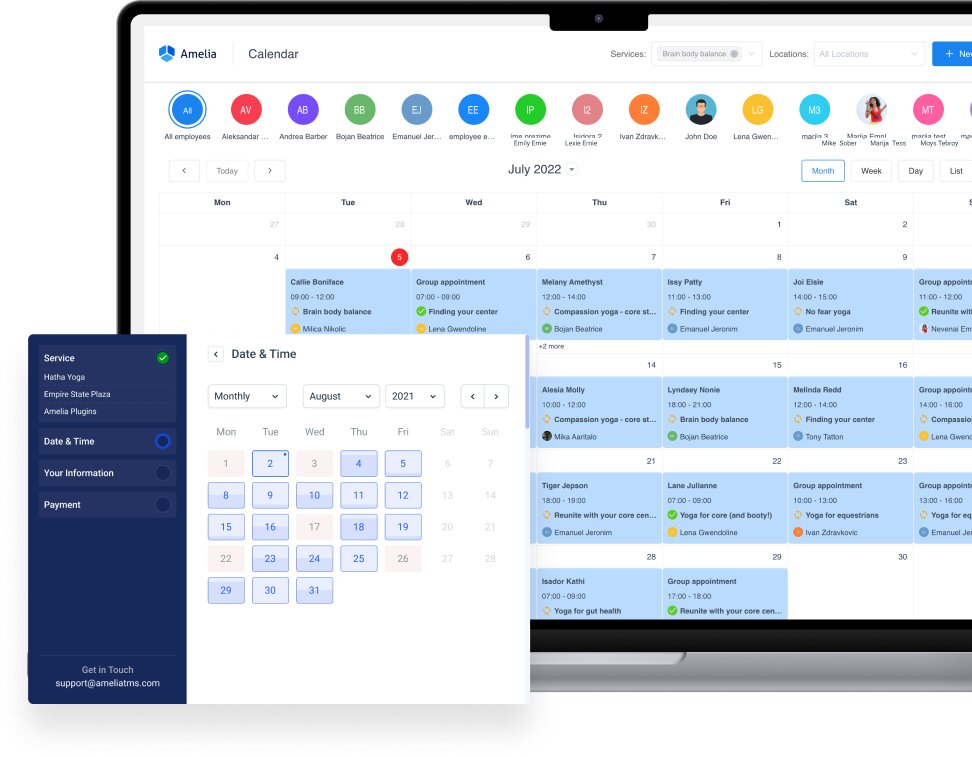

Let’s see how Amelia’s deposits, upfront payments, and automated invoices can help you improve your business.

The Problems Offline or Post-Service Payments Create

High no-show rates without commitment

When customers don’t pay upfront, it’s easier for them to forget, reschedule at the last minute, or simply not show up. You are left with wasted time on your calendar and lost revenue you can’t recover.

Unpredictable cash flow and last-minute cancellations

Relaying on clients paying on arrival means you only get paid if the client shows. Your weekly revenue swings with cancellations, making it harder to plan staffing, inventory, and marketing spend.

Manual chasing for payments and invoices

Post-service payments often turn into follow-ups: phone calls, emails, and reminders to collect what’s owed. Then you still have to create and send invoices, track who paid, and reconcile everything.

Checkout friction when customers must pay on arrival

Having to bring cash, tap a card on site, or wait at a counter adds friction. Any extra step introduces drop-off risk, especially for busy clients or first-timers who want a quick, modern experience.

Poor tracking for accounting, VAT/tax, and refunds

Without a centralized, digital trial, it’s easy to miss tax details, misplace receipts, or delay refunds. Accounting gets messy, audits become stressful, and reporting takes more time than it should.

How Online Payments in Amelia Solve Those Problems

Upfront commitment with deposits

- Deposits secure the spot, meaning fewer no-shows: Paying at the end of booking process turns intent into commitment and cuts last minute cancellations.

- Flexible amounts per service: Set a percentage or fixed deposit for each service to match its length, demand, or no-show risk.

- Clear cancellation & late-cancel rules: Display your terms at checkout so clients know when a deposit is refundable or forfeited – fewer disputes, and more trust.

Frictionless checkout customers actually complete

- Pay at booking in seconds: Clients finish checkout in a few taps, which reduces drop-off.

- Popular cards and wallets supported by your chosen providers: Offer familiar methods via Stripe, PayPal, Square, Mollie, Razorpay, or WooCommerce.

Automated admin

- Confirmation and payment receipts sent instantly: Clients and staff get automatic confirmations without manual follow-ups.

- Optional invoice issues automatically for each paid booking: Turn on invoicing once and keep clean records for every transaction.

- Centralized payment records inside Amelia save time: View all payments in one place instead of chasing spreadsheets.

Clear policies, fewer disputes

- Display deposit, refund, and reschedule terms: Set expectations upfront to minimize disputes and confusion.

- Consistent rules across staff/services: Apply the same policy everywhere for a fair, predictable experience.

What You Can Accept with Amelia

Full upfront payments: Charge the entire service price at booking to lock in attendance and stabilize cash flow.

Deposit payments to secure a slot: Take a percentage or fixed amount now and collect the remainder later, on site or through your chosen payment method.

On-site and online options: Offer both if your policy allows, combining quick online checkout with in-person payments where appropriate.

Refunds via your provider: Handle refunds through Stripe, PayPal, Square, Mollie, Razorpay, or WooCommerce following their standard process, while Amelia keeps the booking and payment records in sync.

Payment Providers You Can Use with Amelia

Stripe

- Global coverage with popular cards and wallets where available.

- Good default for most online service businesses.

PayPal

- Trusted brand recognition with PayPal balance plus cards.

- Great for audiences that prefer PayPal checkout.

Square

- Strong for businesses that also take in-person payments via POS.

- Useful if you want online and on-site consistency.

Mollie

- Excellent EU coverage with local payment methods (varies by country).

- Strong choice for European businesses.

Razorpay

- Popular with businesses selling in India.

- Local payment options and compliance focused on that market.

WooCommerce

- Use WooCommerce gateways you already have.

- Leverage coupons, taxes, and reporting inside WooCommerce.

Set up Payments in Minutes

- Enable online payments in Amelia.

- Connect your provider (Stripe, PayPal, Square, Mollie, Razorpay) or use WooCommerce.

- Turn on Deposits and set amounts per service.

- Enable Invoices and add business/tax details.

- Add your cancellation & refund policy to booking notifications and checkout.

- Test a booking end-to-end, then go live.

Best Practices & Tips

- Keep deposit rules simple and visible: Show the deposit amount and refund conditions at checkout and repeat them in confirmations. Clarity cuts disputes and supports load.

- Use reminder emails & SMS to reinforce commitment: Schedule automatic reminders 24-48 hours before the appointment with a quick link to reschedule.

- Offer 2-3 most relevant payment methods for your region: Prioritize what your customers actually use to keep checkout fast and reduce drop-off.

- Train staff on deposits, reschedules, and refunds: Provide step-by-step guidance in Amelia so the team handles edge cases consistently.

Closing Thoughts

Amelia can help you turn uncertain bookings into real commitments with online payments. Clients complete checkout in seconds using Stripe, PayPal, Square, Mollie, Razorpay, or your existing WooCommerce gateways, and Amelia issues invoices automatically while keeping all payment records in one place.

No matter what type of business you run, the set up is quick and easy. The result is a cleaner calendar, fewer last-minute cancellations, and a smoother experience for both your team and the clients!